Summary Points:

· Track Altcoins Against Bitcoin: Focus on altcoins' performance against Bitcoin instead of USD, as Bitcoin generally outperforms most altcoins over time.

· Cardano Example: A case study of holding Cardano (ADA) highlights the risk of not selling during peaks, as the price eventually dropped, showing altcoin volatility.

· BTC Pairing Strategy: Monitoring altcoin/BTC pairs helps identify when an altcoin is outperforming or underperforming Bitcoin, leading to better trade decisions.

· Timing with Cycle Indicator: Using a Cycle Indicator based on Stochastic RSI can signal when altcoins are primed to outperform Bitcoin, maximizing potential gains.

Most altcoins lose value over time when compared to Bitcoin. Instead of focusing on their USD price, smart traders track how their altcoins are performing against Bitcoin. This strategy could completely change the way you trade.

👋 Know the next move in Bitcoin before it happens, subscribe here!

The Cardano (ADA) Lesson

In December 2017, Cardano (ADA) was hot. After buying at $0.38, its price soared to $1.10 by early 2018. But then it crashed, and two years later, it was worth just $0.035—a 97% loss. Fast forward to 2024, and even after hitting a high of nearly $3 in 2021, ADA is back down to $0.35. The takeaway? Altcoins are unpredictable and often disappointing when viewed in USD.

Let me paint a picture for you. It’s December 17, 2017, and you’ve just jumped into the crypto hype by investing in Cardano (ADA) at around $0.38 per token. The excitement is electric, and within weeks, the price skyrockets to $1.10. You’re feeling like a genius, enjoying a nearly 3x return in no time. So, you decide to hold on, convinced this is only the beginning.

Big mistake.

Instead of soaring higher, Cardano starts to tank. Fast forward two years, and that $0.38 investment has plummeted to a devastating $0.035. You’re down nearly 90%, yet you remain hopeful—sure that the comeback is around the corner.

In early September 2021, it happens—sort of. Cardano rockets to nearly $3 per token, offering an 800% return. But again, you don’t sell, believing the bull market will carry it even higher.

Another mistake.

Now it’s September 2024, and Cardano is sitting at around $0.34. After seven long years, your initial investment is actually at a loss. To make matters worse, Cardano has dropped from being the 6th largest cryptocurrency to 11th. It’s been a brutal ride, and you’re still waiting for that payoff.

Why Bitcoin is the Key

So, what’s the takeaway? Altcoins, even those as hyped as Cardano, can be financial traps if you don’t play them right. Most investors track their altcoins in USD, but here’s the hard truth: that’s often misleading. In the wild world of crypto, what really matters is how your altcoins are performing against Bitcoin.

Bitcoin is the king. When it’s on a run, most altcoins struggle to keep up. But occasionally, an altcoin will outperform Bitcoin—even in a down market—and that’s where the real opportunity lies. By focusing on altcoin/BTC pairs, you’re not just growing your USD balance—you’re growing your Bitcoin stack. And that’s the name of the game.

The Right Way to Track Altcoins

If you want to be a smart investor, stop tracking altcoins only in USD. Instead, start paying attention to how they perform relative to Bitcoin. If an altcoin is gaining ground on Bitcoin, it could be a sign that it’s worth holding—or even buying more. On the flip side, if it’s losing to Bitcoin, it might be time to cut your losses and move on.

By focusing on altcoin/BTC charts, you’re better positioned to maximize your gains, rather than getting caught up in the USD volatility. After all, it’s not just about increasing your fiat balance—it’s about accumulating more Bitcoin.

Making the Most of This Strategy

Jumping into any trending altcoin might seem tempting, but it’s crucial to be strategic. In my free weekly newsletter, I dive deep into altcoin trading strategies that help you navigate this unpredictable market. Want timely insights on when to buy or sell altcoins? Subscribe below to receive alerts, including when to shift your focus back to Bitcoin.

Timing the Altcoin Market

To profit from altcoins, you need to know when an altcoin has reached its cycle bottom. That’s why I developed a proprietary Cycle Indicator based on Stochastic RSI, which alerts you when an altcoin is primed to outperform Bitcoin. Stay ahead of the market by subscribing to my newsletter—you’ll receive these powerful signals directly to your inbox. Don’t forget to mark my emails as important so you never miss a crucial update.

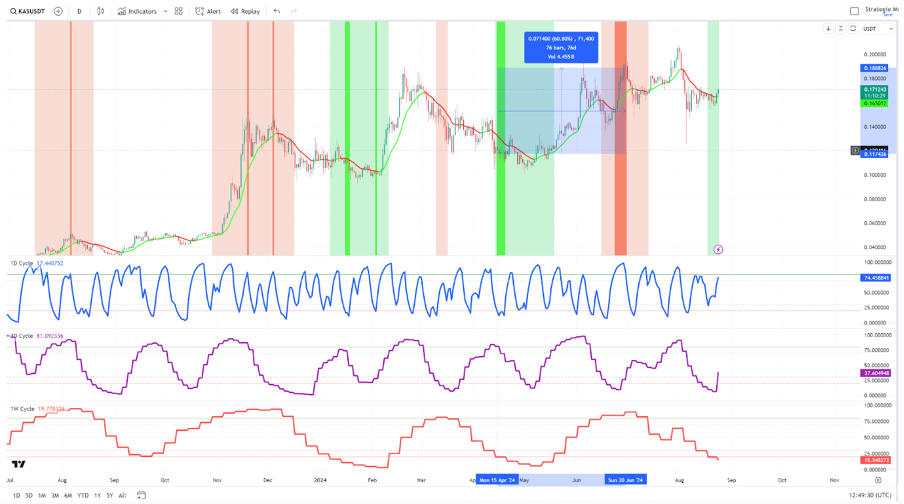

Example: KAS/BTC Strategy

Let’s see this strategy in action. Take the KAS/BTC pair on a daily timeframe. On January 18th and April 19th, 2024, my Cycle Indicator flashed light green signals—marking key reversals in the KASPA pair. Following these signals led to 40% and 70% gains against Bitcoin, with over 60% gains in USD terms during those periods. These are the types of opportunities I share with my subscribers.

By using this approach, you can cut through the noise and make more informed decisions about when to buy, sell, or hold an altcoin. It’s all about finding those reversal points in altcoin/BTC charts—not just focusing on altcoin/USD movements.

Conclusion

Crypto is a rollercoaster, and altcoins are some of the wildest rides. But by tracking your altcoin/BTC, you can turn that volatility into opportunity. Don’t fall into the trap of only watching USD values—focus on what truly matters: your Bitcoin holdings.

Start tracking BTC pairs, and you might just catch the next big wave before it crashes. Want to stay ahead of the game? Subscribe to my newsletter now for exclusive insights and real-time market alerts.

Stay smart. Trade smart.