Summary:

Simple Strategy: Use two free TradingView indicators — WaveTrend Oscillator and WaveTrend with Crosses — to predict altcoin movements and avoid crashes.

Setup: Apply this strategy on the SOL/BTC chart with a Daily timeframe, adding the indicators to spot optimal buy/sell points.

Proven Results: This method has shown up to 82% profit in just 22 days, even during market consolidations.

Risk and Reward: It offers a 75% win rate, with potential improvement to 85% using advanced Cycle Indicators available through a free newsletter.

What if I told you there’s a simple strategy that can alert you before an altcoin crash?

Imagine having a free tool at your fingertips that can pinpoint the best times to buy and sell altcoins.

The best part?

You only need two indicators, both available for free on Trading View platform.

👋 Get your FREE indicator to catch 100X Altcoins!

Here’s how you can set it up:

Head over to TradingView, open the $SOL/$BTC chart, and select the Daily timeframe. Using this timeframe helps you spot the best entry and exit points for the coming weeks, allowing you to capitalize on bullish trends and potentially earn between 50% and 70% profit.

Add 2 Key Indicators:

- Click on "Indicators" and search for “WaveTrend Oscillator + Divergence + Direction”—add it to your chart.

- Next, search for “WaveTrend with Crosses” and add that too.

These indicators work great with SOL/BTC because we’ve identified SOL as a strong altcoin. (If you want to learn how to spot high-potential altcoins yourself, check out my previous articles!)

How to Use the Indicators

The key to success with the WaveTrend Oscillator is filtering out bad entries. Our goal is to catch the end of bearish phases and get in at the right time. Here’s how:

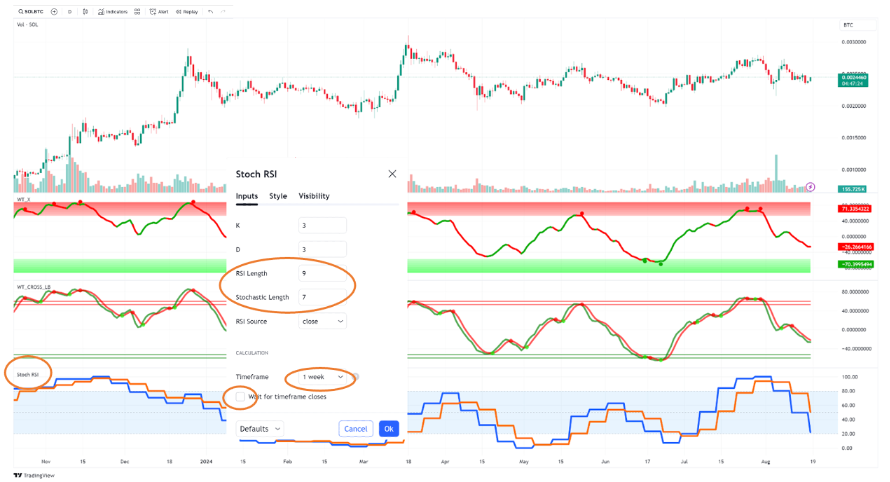

Add the Stochastic RSI Indicator:

- Only consider entries when the Stochastic RSI is below 20.

- Adjust the RSI length to 9 and the Stochastic length to 7 to make it more responsive to price changes.

- Set the timeframe to Weekly and save your settings.

Before diving into the strategy, let’s understand what the WaveTrend Oscillator is. It’s a tool that helps traders spot trend reversals and market momentum. Unlike basic indicators like moving averages or MACD, it considers both price and volume data, making it perfect for the volatility of altcoins.

The WaveTrend Oscillator generates a line that oscillates between overbought and oversold conditions, helping you identify potential buy and sell points.

- The “WaveTrend Oscillator” gives fewer signals but is more accurate, typically providing one trade opportunity per month. Depending on your risk tolerance, you can use either indicator to confirm a reversal.

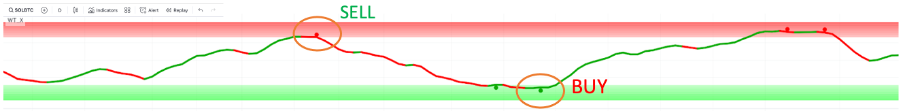

- The “WaveTrend with Crosses” indicator will show a green line for buying opportunities and a red line for selling.

Putting the Strategy to Work

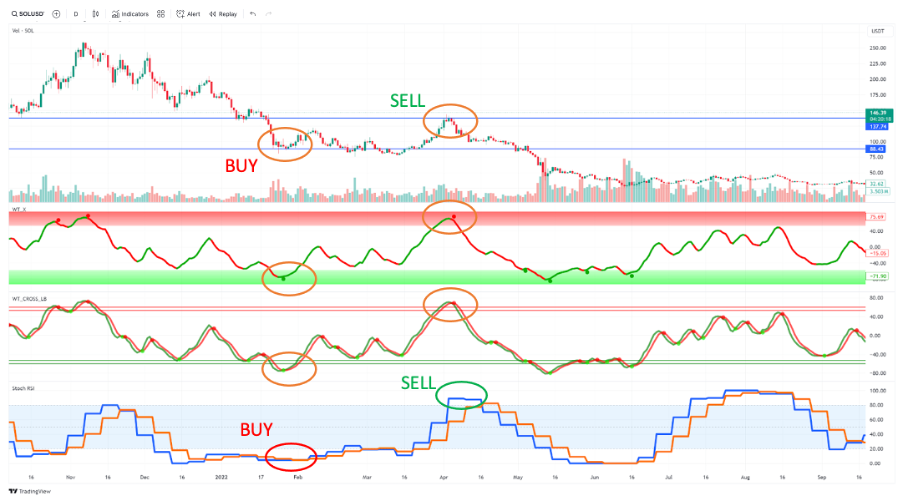

Let’s find a time when the Weekly Stochastic RSI was below 20. The last time this happened was in February 2024. We also saw two green dots on the WaveTrend Oscillator, signaling a strong buying opportunity. If you entered the trade at this point and exited when the indicator hit the red zone, you could have made a 42% gain on the $SOL/$BTC chart.

To see this in dollar terms, switch to the $SOL/$USDT chart. Entering on February 26th and exiting on March 20th would have given you an incredible 82% profit in just 22 days—and this was during a market consolidation phase!

But this isn’t just a one-time success. Let’s look at a similar opportunity during the bear market of 2022. In January, the Weekly Stochastic RSI dropped below 20, and the WaveTrend Oscillator showed a green dot. By entering the trade on January 28th and exiting on April 5th, you could have outperformed Bitcoin by 13%. On the $SOL/$USDT chart, this trade would have netted you a 30% profit while most coins were declining.

The "WaveTrend with Crosses" indicator gives multiple entry and exit points during this period. Although trading outside the green and red lines is riskier, it can yield higher profits if you're willing to take the risk. For instance, on January 26, 2024, $MATIC/$USDT saw the "WaveTrend with Crosses" indicator hit the green line, signaling an entry. The price of $MATIC quickly rose from $0.74 to $1.02, and both indicators then signaled an exit.

While this strategy comes with some risk, it offers substantial opportunities in rising markets. You can expect a 75% win rate using this method. To push your win rate to 85% and start generating significant profits, consider using my Cycle Indicators, which I cover in my free weekly newsletter.

Want to learn more? Subscribe to the newsletter by clicking the link: https://strategymaster.io/subscribe/

Have a great week, and see you soon!