How Human Emotions Drive Markets—And How You Can Stay Ahead

Summary points:

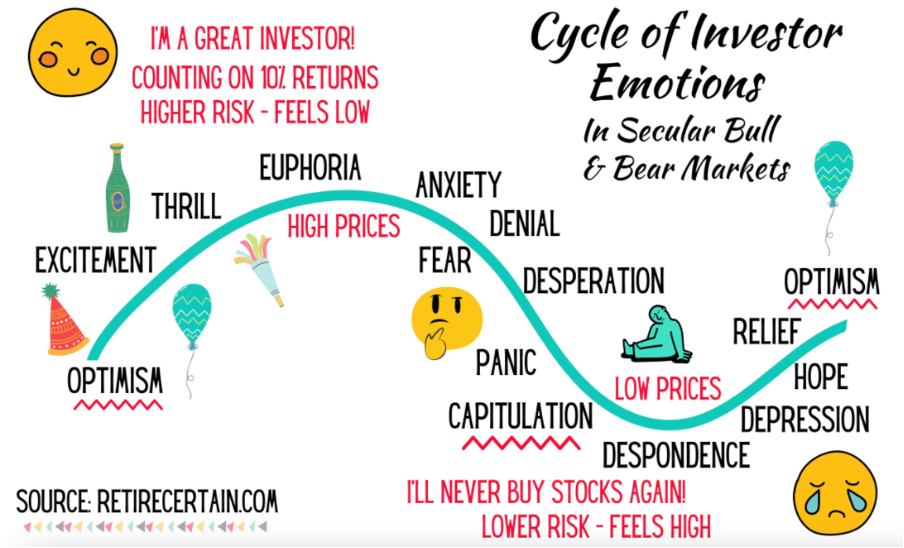

· Market cycles are driven by human emotions like optimism, fear, and greed, causing growth followed by corrections.

· Bull markets are fueled by excessive optimism, low-risk awareness, and too much capital, often signaling a peak.

· Cycles follow a pattern: growth, peak, correction, and eventual bottom as fear returns.

· Understanding these cycles helps investors recognize key turning points and act rationally during market shifts.

Markets and economies are constantly moving in cycles. Sometimes they boom, and other times they bust. What’s driving these fluctuations? It’s not just numbers or technical factors—it’s human behavior. Understanding the emotional forces behind these cycles is the key to navigating market ups and downs successfully.

👋 Know the next move in Bitcoin before it happens, subscribe here!

Why Do Cycles Happen?

At the core of every cycle are excesses and corrections. When markets or economies grow, they often go too far, creating a bubble. Eventually, this bubble has to pop, leading to a downturn or correction. But why doesn’t growth stay consistent?

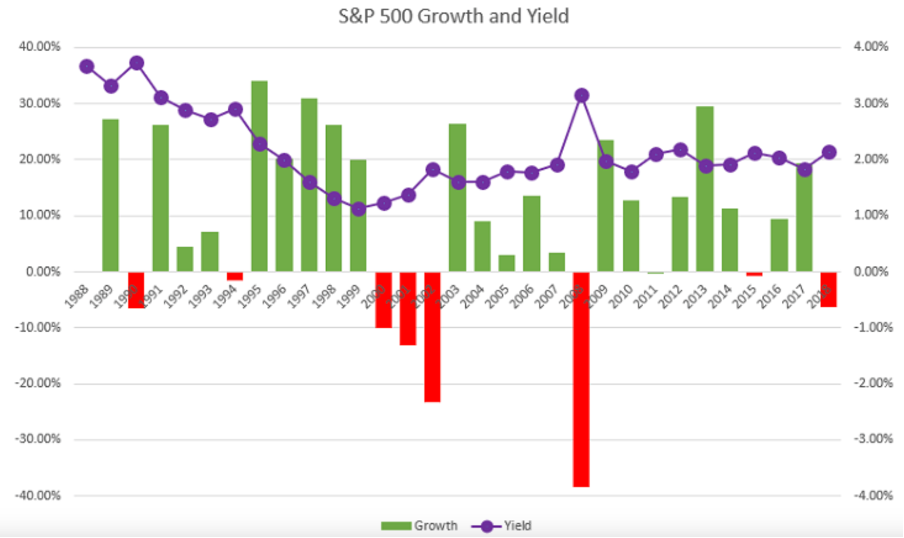

Take the U.S. economy. On average, it grows about 2% per year. However, in reality, growth is all over the place—sometimes 3%, sometimes 1%, and occasionally even negative during a recession. Similarly, the stock market has averaged around 10% growth per year over the past 90 years. But in any given year, the returns are rarely right at 10%—instead, they’re often wildly different, either soaring or plunging.

What causes this inconsistency? Human emotions like optimism, fear, greed, and risk-taking. Markets aren’t just mechanical systems—they’re driven by people, and people are unpredictable. When emotions take over, cycles form.

How Cycles Play Out in the Economy

Here’s a simple example: When companies expect strong demand, they expand—building new factories, hiring more workers, and producing more goods. If many companies do this simultaneously, the economy grows faster than usual, creating an upcycle. But eventually, too much capacity gets built, leading to a correction. Factories close, layoffs begin, and the economy slows, often in recession.

How Cycles Work in Financial Markets

Financial markets behave the same way. When investors are optimistic, stock prices rise—sometimes much faster than the actual growth of companies. Take the 1990s, when stocks in the S&P 500 grew by 20% annually, even though the companies themselves weren’t growing nearly as fast. This creates excesses, and eventually, a correction must occur. Booms are followed by busts, and bull markets are followed by bear markets.

The Recurring Themes That Drive Bull Markets

Every market cycle is different, but certain themes tend to repeat during bull markets. Recognizing these themes can help you spot when a market is nearing a peak:

- Excessive Optimism: When investors get overly excited, they start paying more for assets than they’re worth. This optimism inflates prices beyond what the fundamentals justify—leading to bubbles that eventually burst.

- Low Risk Aversion: Normally, investors are cautious and demand a margin of safety. But in a rising market, people become less concerned about risk. The fear of missing out (FOMO) takes over, and investors start making riskier bets.

- Too Much Capital: During bull markets, there’s often an excess of money chasing too few investment opportunities. When too much capital floods the market, prices skyrocket, and returns shrink. This is another sign that a correction may be coming.

The Typical Market Cycle

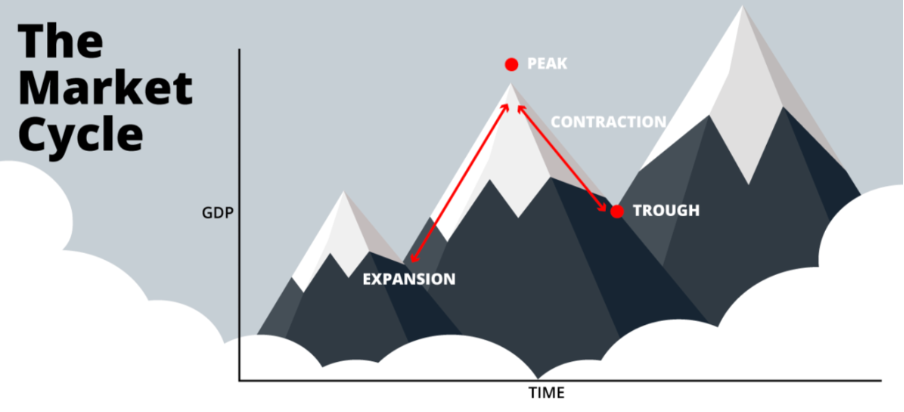

Here’s how a market cycle usually unfolds:

- The Beginning (Expansion): After a period of poor performance, fundamentals start to improve. Company earnings rise, good news dominates, and investors grow optimistic. Capital becomes easier to access, and asset prices start climbing.

- The Peak: Optimism turns into euphoria. Investors forget about risk, and prices soar to unsustainable levels. Everyone wants to buy, pushing the market to its peak.

- The Correction (Contraction): The fundamentals weaken, and bad news begins to emerge. Prices start to fall, and fear takes over. Investors rush to sell, and risk aversion returns.

- The Bottom (Trough): At the lowest point, prices are extremely cheap, and risk is low—but most investors are too fearful to buy. This is when the next cycle is about to begin.

Stay Ahead of the Market

The key to successful investing is understanding these cycles and recognizing when the market is approaching a peak or a bottom. Human emotions—like optimism and fear—don’t change, so cycles will always exist. The smart investor knows how to spot the signs of excess and correction and act accordingly.

That’s exactly what we focus on in our newsletter. We track market cycles, especially in the world of crypto, and help you identify turning points so you can stay ahead of the next big move.

Subscribe below to get cycle insights straight to your inbox and learn how to navigate the ups and downs with confidence.

Unlock the secrets of market cycles—subscribe now and stay ahead of the curve!