Summary points:

- Bitcoin Halving: The latest Bitcoin halving in April 2024 hasn't sparked a rally yet, unlike previous cycles.

- Historical Patterns: After past halvings (2012, 2016, 2020), Bitcoin saw both dips and eventual rallies, but these may align with broader market cycles rather than the halving itself.

- Cyclical Trends: Bitcoin’s price follows a repeating pattern of three bullish years followed by one bearish year, regardless of the halving.

- Possible Rally: A rally could still happen by the end of 2024 or into 2025, following market cycles like the Dotcom bubble.

We’ve all heard the hype—every four years, Bitcoin goes through a “halving,” and many expect this event to trigger a massive price rally. The most recent halving took place in April 2024, but so far, no big surge has happened. So, is the halving really as crucial to Bitcoin’s price as people think? Let’s break it down.

What Is the Bitcoin Halving?

The Bitcoin halving, or "halvening," is one of the most hyped events in Bitcoin’s history. It's predictable and happens roughly every four years—when the number of new bitcoins entering circulation every 10 minutes (block rewards) is cut in half. The last one was in April 2024, when the block reward dropped from 6.25 to 3.125 BTC.

It is easy to see this event coming, as it happens every 210,000 blocks. Since Bitcoin’s inception in 2009, it has occurred four times, including this year's halving.

Past Halvings: A Mixed Bag

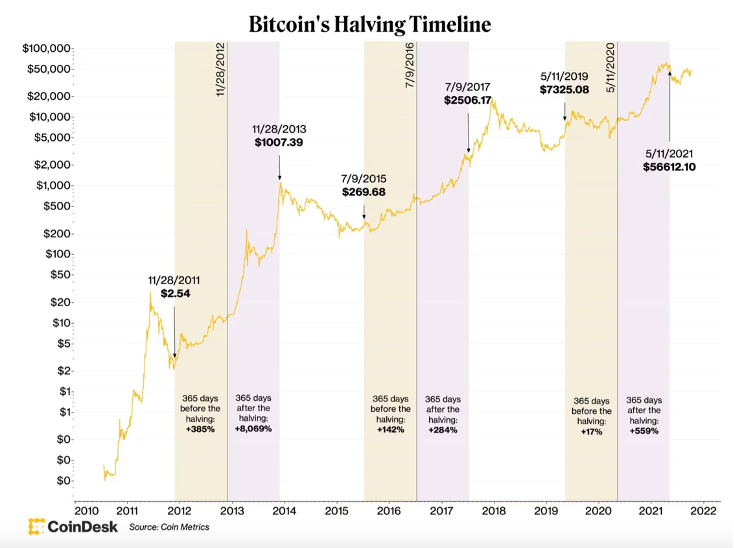

Looking at previous halvings (2012, 2016, and 2020), Bitcoin’s price showed a mix of dips and rallies:

- In 2012, Bitcoin jumped from $12 to $256 in just over 100 days.

- In 2016, it initially dipped before skyrocketing to $20,000 in late 2017.

- In 2020, it took about 150 days for the rally to start, leading to a peak of $68,000.

Let’s look back: During the 2012 halving, Bitcoin was priced at $12 and shot up to $256 in just 133 days. In 2016, Bitcoin was at $646 before the halving, but it dropped to $540 in the months that followed. The big rally only began later, leading to the December 2017 peak of $19,600. Then came a bear market, a new rally, and the May 2020 halving. At that time, Bitcoin was priced at $8,900. It took about 150 days before the rally kicked in, eventually driving Bitcoin to $64,000 within a year. Then, it retraced to $30,000 before reaching a new all-time high of $68,000, followed by a long drop to $16,000. In 2024, Bitcoin climbed to $73,000 by March, but as of the April halving, it was back down to $65,000. Since then, it’s drifted to around $53,000.

Here's the catch—on 2024 it hasn't happened yet this time. However, it’s worth noting that these rallies may be part of larger market cycles rather than directly caused by the halving. According to the "Halving Theory," Bitcoin's bull market should start a few months after the halving. Today, it’s October 2024, and everyone is waiting for that rally.

Bitcoin's Cycles: More Than Just Halvings

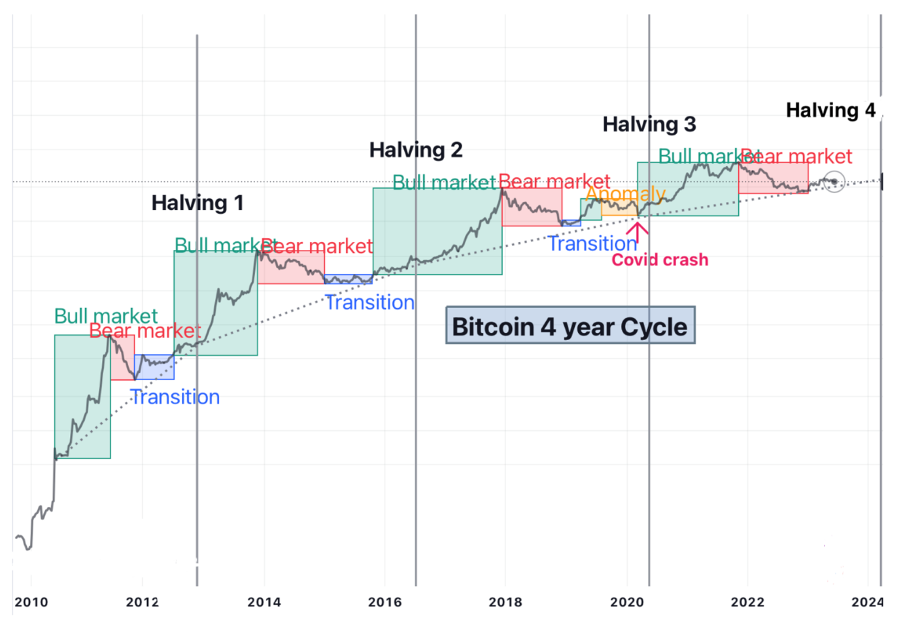

Does the halving predict Bitcoin rallies? In 2020, the halving followed a bear market, and prices went up. This time, Bitcoin had already quadrupled in value before the halving. It seems like bull and bear markets are not directly linked to the halving event. The price has generally gone up after halving, but the reality is that Bitcoin has been in a steady uptrend for the past 15 years, with or without the halving.

Bitcoin moves in yearly, monthly, weekly, and daily cycles, and the halving just happens to fall within those cycles. Each cycle has phases of retraction, consolidation, and rallying. Whether a cycle is bullish or bearish depends on whether it’s "left-translated" (bearish) or "right-translated" (bullish).

Since 2011, Bitcoin has followed a repeating pattern of three bullish (green) years followed by one bearish (red) year—2014, 2018, and 2022 were all down years. This suggests Bitcoin moves in predictable cycles, regardless of the halving. If history repeats, we might expect three more green candles, followed by a red one in 2026. But it’s not that simple.

A yearly cycle consists of smaller weekly and daily cycles. Weekly cycles can either be left-translated (bearish) or right-translated (bullish). A right-translated cycle means the peak happens later in the cycle, while a left-translated cycle peaks earlier. Over the years, we have seen many of these shorter cycles, but Bitcoin has never experienced a left-translated yearly cycle.

Since 2011, Bitcoin has only had three major right-translated yearly cycles, which is similar to what happened in the Dotcom boom and bust. The Dotcom cycle ran from 1988 to 2003 and saw three right-translated cycles, followed by a big bearish left-translated one from 1999 to 2003.

There are a lot of parallels between Bitcoin and the Dotcom bubble. If Bitcoin follows a similar path, we might see one more big rally in the next three months, even though the market currently feels bearish with Bitcoin sitting at $60,000 (10th October 2024).

What’s Next for Bitcoin?

Although 2024 has been bearish so far, many believe Bitcoin could still see a rally by the end of the year or into 2025. If history repeats itself, we might be looking at a major price increase as part of Bitcoin’s natural cycles, even if it’s not directly tied to the halving.

Stay tuned for more updates on Bitcoin’s cycles and market trends—subscribe to our newsletter for regular insights, and stay ahead of the game! It’s free, and you’ll get updates three times a week on daily, weekly, and yearly Bitcoin cycles.

Follow the cycles, stay informed, and ride the waves!