Summary:

Timing Altcoin Season: Waiting for the Altcoin Season Index to hit 75 often means missing the best gains.

Smart Altcoin Picks: Early investments in altcoins like SEI can yield huge returns, while others like EOS might disappoint.

Smart Money Moves: Track altcoins backed by recent big investments for higher potential gains, using platforms like CryptoRank.

Quick Recovery Signals: Focus on altcoins that recover fast after market dips—they typically perform well afterward.

Entry Strategy: Use the Weekly Stochastic RSI to time buys and consider subscribing to newsletters for advanced strategies.

Have you ever followed a YouTuber’s advice to buy altcoins when the Altcoin Index hits 75, dreaming of turning $1,000 into $100,000?

You make the move, thinking you’ve outsmarted the market, only to watch your portfolio drop by 50%. What went wrong?

I’ve been there too. Give yourself 5 minutes of reading this article , and you will be ready for the next altcoin season.

Read till the end, I will share tips on how to find coins with 10x potential on your own.

👋 Want to avoid altcoin crash? Subscribe here!

What Is Altcoin Season?

Altcoin season is when altcoins—cryptos other than Bitcoin—start to outperform Bitcoin in percentage gains. During this time, investors pour money into altcoins, causing their prices to skyrocket.

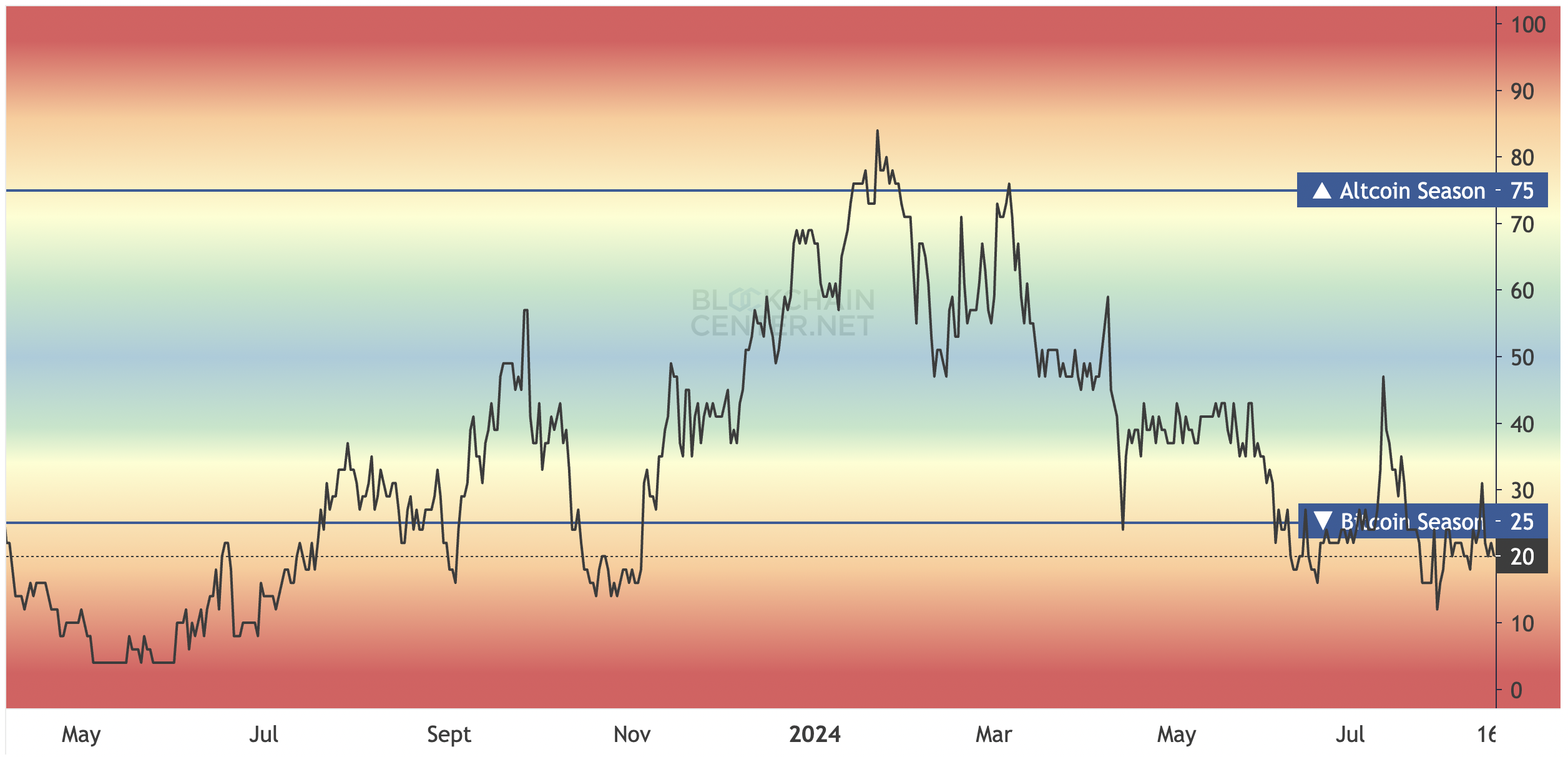

So, how do you know when it’s altcoin season? One popular method is the Altcoin Season Index. It compares the performance of the top 50 altcoins against Bitcoin over 90 days. If 75% of these altcoins are beating Bitcoin, you’re in altcoin season!

But here’s the reality: if you wait for the index to hit 75, you’re already too late. By then, most of the gains have already been made. The key is to spot the right altcoins early, right when Bitcoin starts its rally.

Real-Life Examples: The Hits and Misses

Take $SEI, for example. $SEI surged from $0.10 in October 2023 to $1.00 by February 2024. If you had invested $1,000 in $SEI at the end of 2023, you’d have turned it into $10,000 in just a few months!

Meanwhile, Bitcoin ($BTC) rose from $27,000 to $60,000 during the same period—a solid 120% gain. But $SEI’s return was much more impressive.

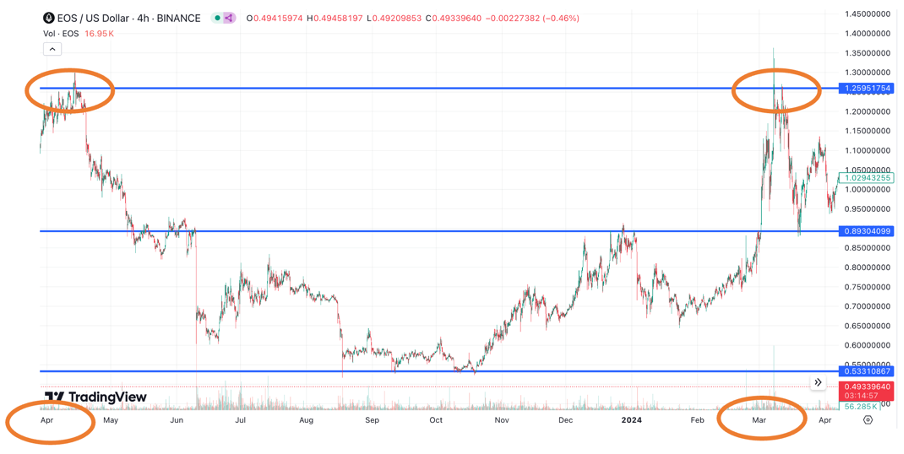

Now, let’s look at $EOS. From October 20223 till February 2024, $EOS only grew up 80% and by March 2024 gained 140%, going from $0.50 to $1.20. But buying EOS at $0.50 was tricky because it had been in a downtrend for years.

If you bought too early, like in April 2023 at $1.25, you wouldn’t have made any profit, even after Bitcoin’s rally. Unfortunately, this happens with most altcoins like $DASH, $NEO, and $HFT—they often never return to their previous all-time highs.

How to Find the Next Big Altcoin

So, how do you find altcoins like $SEI with huge potential?

It’s easier than you think, and there are two simple ways:

- Follow the Smart Money:

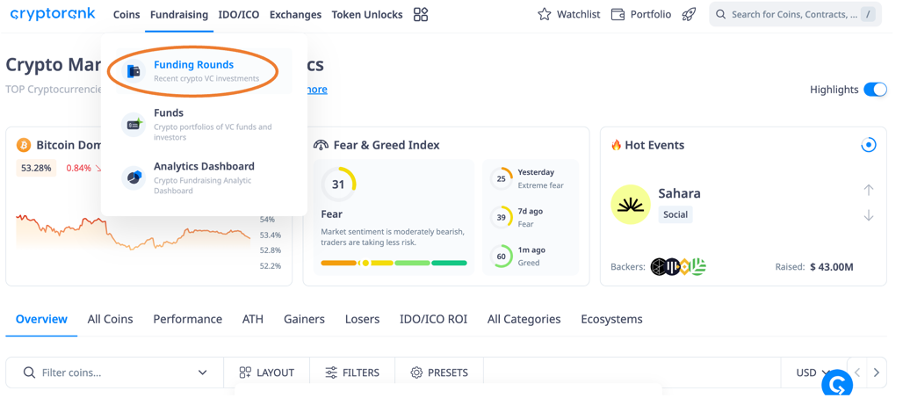

Visit CryptoRank.io.

Click on “Fundraising” then “Fundraising Round”. Look for projects that received significant investments in the last 6 - 14 months. Make sure these projects have a coin and are backed by top-tier investors. These coins have the best chance of delivering 5x or 10x returns.

Big investors usually have the resources to push these coins higher through exchange listings, market makers, and aggressive marketing.

For example, during the 2021 bull market, Decentraland hit over $5. But in 2024, it struggled to reach $0.80 before dropping back to $0.30.

This shows how quickly venture capitalists move on after cashing out, leaving regular investors holding the bag.

- Watch the Recovery:

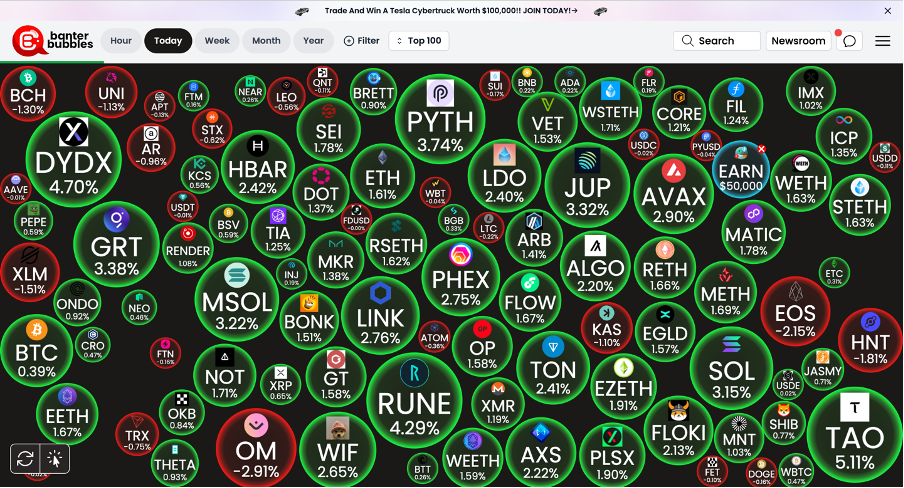

Check which coins bounce back the fastest after a small market crash. You can find this info on banterbubbles.com by selecting “Today.”

The coins that recover quickly usually perform well in the following months.

When to Buy?

Once you’ve identified the right coins, when should you buy them? A simple trick is to apply the Weekly Stochastic RSI and wait for it to drop to 20. For even better buy and sell signals, subscribe to my free Newsletter to avoid missing new articles.

We dive into the Cycle theory, which offers more precise entry and exit points than Stochastic RSI.

Cycle theory - just straightforward advice.